Horseshoe Wallet Theory

PayPal’s recent partnership with MetaMask to facilitate cryptocurrency purchases may seem like an unlikely pairing, but it actually makes sense for both parties. But why the love between web2’s biggest wallet and web3’s biggest?

- Paypal wants to expand into new markets

- Payment apps derive network effects from their two-sided marketplace of users<>merchants

- Web3 wallets allow users to securely store and send crypto. They don’t have network effects, and they are akin to banks where economies of scale and brand matter.

- Web3 wallets are becoming the entry point for Defi, identity, storage, computation, & social. Instead of building for each use case, Metamask is becoming a platform for apps.

- By becoming platforms, Web3 wallets are trying to onboard indirect wallet effects. Every app that joins Metamask increases the utility that users get.

History of Fintech Wallets

Paypal was one of the earliest fintech apps to achieve a major milestone by reaching one million users in 1999. Thiel attributed this success to a simple strategy-giving each new user $10 upon signing up. Paypal had a simple job to be done- send money safely over the internet. But it didn’t scale until they figured out the right distribution strategy: Ebay’s power sellers who wanted a faster means of payment than money orders. Paypal signed up over 25% of top Ebay’s power sellers and attracted a significant number of users who wanted to purchase items on eBay. New users realized that they could also use Paypal to send money to other friends who signed up or pay securely at any of the merchants supporting Paypal. The two-sided network became a critical competitive advantage, and Paypal continued to grow quicker than eBay’s own payments competitor- Billpoint. By the time eBay acquired Paypal for $1.5 Bn in 2002, the company was processing $1.5 Bn every quarter and handled 70% of eBay’s payments.

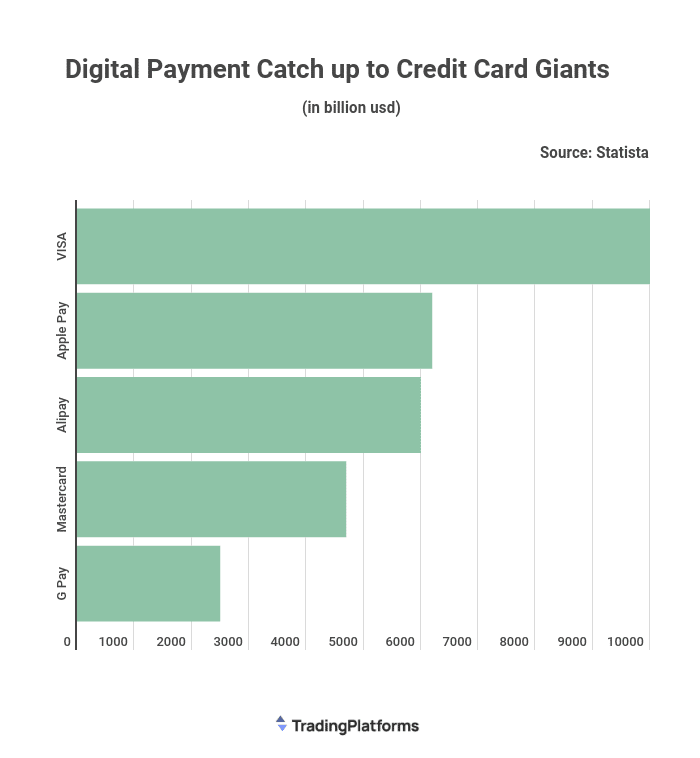

Many Web2 startups jumped onto the payments bandwagon, albeit most including Google Wallet, Chase Pay, and Square Wallet failed to grow. Successful apps like Venmo, which helps users split bills with friends, and Affirm, which allows payments to be split into installments, found specific use cases to drive growth. There are more than 300+ Fintech unicorns dominating the online payments market, closing the gap with traditional credit card giants.

A large part of the reason digital payments are catching up to Credit Cards is Apple Pay. Apple Pay already processes more payments than Mastercard and will most likely beat Visa soon. Instead of fighting with cards, Apple gave users the ability to secure their card details through tokenization and pay at any store with just a tap. By integrating themselves as the intermediary, they provide an additional layer of security and convenience for users.

While fintech apps are expanding their capabilities by integrating with banks to offer a range of financial services, such as tracking spending habits and managing savings, banks still control the power dynamic as users’ funds are ultimately stored with them.

Network Effects in Fintech

NFX is a leading researcher in startup moats and identifies four forms of defensibility – Network effects, Brand, Embedding, and Scale. They argue that network effects are the most potent form of defensibility, accounting for 70% of tech company value creation.

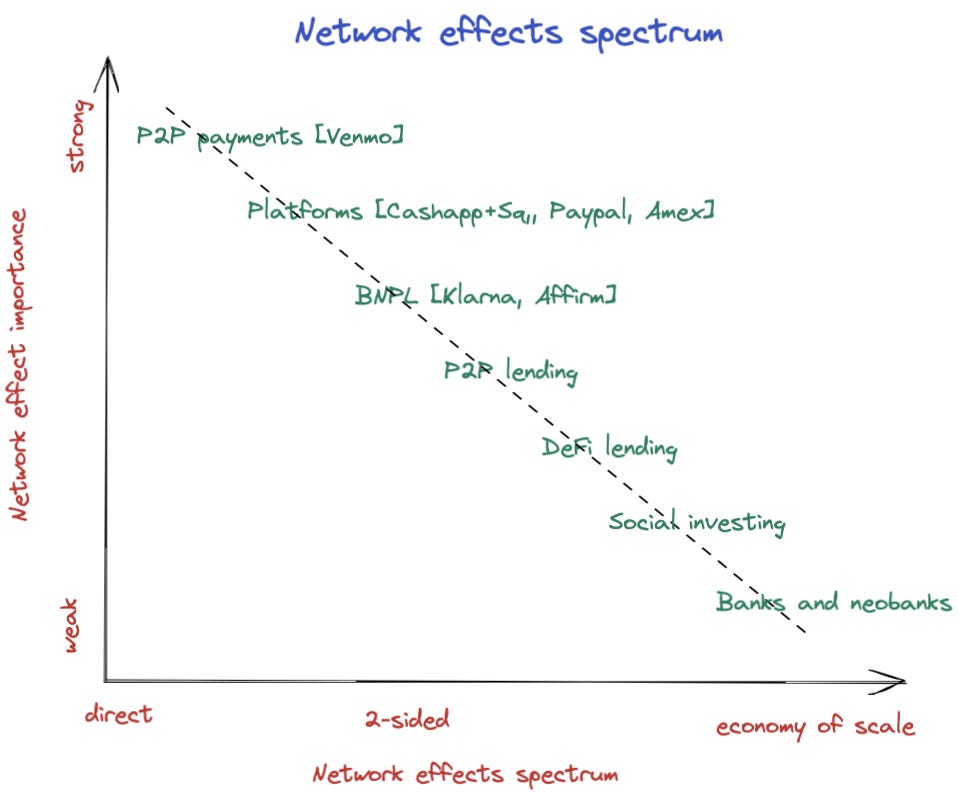

Aika, a Strategy manager at Wise wrote an excellent piece detailing the network effects of Fintech companies. She mapped fintech business models against two axes: network effects and jobs served. She observed that companies that have direct network effects can ramp up and grow very fast by having just a simple one-use-case product. On the other hand, the companies that provide deep and broad services, depend on network effects to a much lesser extent. The weaker the network effects, the more jobs the company tends to serve.

- P2P payments– Direct network effects are strong, adding one more participant increases the network of friends to send and receive money. Platforms such as Cashapp embraced this from day one and approached banking like a social media app. Even though Cash launched 2 years later than Venmo, they targeted lower-income communities that Venmo had overlooked and launched specifically in the American South region. They embedded themselves into the Black culture as Cash App’s network effect became particularly strong in the Black community. They partnered with rappers such as Lil Nas X, Travis Scott and Cardi B and announced Million dollar giveaways. If you wanted to enter the giveaway, you had to post a comment with your own #cashtag on your socials. They built a strong reputation for p2p payments before expanding their product portfolio.

- Platforms– eBay is a double-sided marketplace with indirect market effects. Adding one more seller on eBay doesn’t benefit other sellers, in fact, it increases their competition. However, having a large number of sellers increases product selection and availability making eBay more attractive to buyers. This increase in buyers brings more revenue to all merchants. BNPL platforms like Klarna and Affirm fall into this category. Affirm lets you split your purchase into installments and pay at major merchants. One more friend joining Affirm doesn’t increase the amount of utility that you as a buyer gets, but an increasing user base attracts more brands to provide Affirm option at checkout.

- P2P lending– P2P Lending faces the daunting challenge of attracting users on both sides of the marketplace also known as the ‘Cold Start Problem’. Aave the most popular Defi lending app actually started as EthLend a peer-to-peer lending market. Users were required to interact with each other using smart contracts but finding matches for lending and borrowing was not efficient because of varying parameters such as loan value and time horizon. Aave then pioneered the model of liquidity pools where users could deposit funds into a smart contract pool, and users who wanted to borrow funds could tap into this pool whenever they needed funds. By pooling assets on one end, Aave tapped into the network effect of liquidity and quickly grew from $50 Mn TVL in Jan 2020 to $1.5 Bn TVL within 12 months.

- Banks– As we move down to banks and neobanks, we can see that they perform a lot of jobs for users, and economies of scale dictate power here. Even though neobanks were perceived as an existential threat to banks, neobanks could never compete directly with banks and offer ancillary services such as account management, standing instructions, bill payments, loans. Lending/ credit/ core banking remain tightly regulated services in coordination with the central bank. Economies of scale matter here because banks require physical branches for critical services and the density of the bank’s branch presence increases convenience for users. Banks capitalize on the defensibility of Brand – users want to store their hard-earned money in a bank that has decades of credibility and trust that they will always have access to their funds.